- Mint vs ynab budgeting 2019 update#

- Mint vs ynab budgeting 2019 password#

- Mint vs ynab budgeting 2019 plus#

- Mint vs ynab budgeting 2019 download#

- Mint vs ynab budgeting 2019 free#

If you want to create Goals for yourself, you should follow the steps as illustrated below:Īfter this they will have you review your payment plan, where you’ll be able to make any adjustments you need.Īt this point, Mint will give you an overview of your finances and you’ll be able to start developing your budget. You are going to continue adding all type of transactions you typically pay throughout the month, as well as anything you pay yearly or every other month.

Then place the amount to be paid and click on Save If you wish to start every month with the previous month’s leftovers, you can check the box as illustrated below: You will be prompted to choose a category, to state when that payment will take place.

Mint vs ynab budgeting 2019 plus#

Once you’ve added all of your accounts and it’s time to Create a Budget, just click on the plus sign illustrated below to get started. You must log in to all of your accounts through the Mint application. This will allow Mint to start figuring out how much you owe, as well as how much money you have in your accounts. Make sure to include your bank accounts, loans, credit cards, and anything else you might owe on. Then you will be asked to add all of your accounts.

Mint vs ynab budgeting 2019 password#

Password (you’ll be asked to confirm the password once more)Īfter that you will go ahead and select your Country from a drop-down list and place your Zip Code. To start using Mint, register on or through their app Mint does not charge you any fees, and will only make money from their referrals. Then, Mint will refer you somewhere that will be able to help you. Mint evaluates your financial situation in order to provide an alternative solution for you. Security – Coming from the makers of trusted companies like Quickbooks and TurboTax, Mint strives to constantly improve their security measures. This feature will also show all of your investment accounts such as 401K, IRA’s, Mutual Funds and brokerage accounts. Mint will help you compare your portfolio to the market and benchmarks. Investment tracking – Investing well can make all the difference for your future. This feature will help you place your expenses in a category for easier tracking. Simple categorization – Mint’s purpose is to help you create a budget that’s easy to stick to. Any unusual or suspicious activity is seen. Alerts and advice – This feature will alert you whenever there are important changes going on with your accounts. By knowing your score ahead of time, you’ll be able to tell if you qualify for certain financial products, like credit cards, loans, etc. Mint vs ynab budgeting 2019 free#

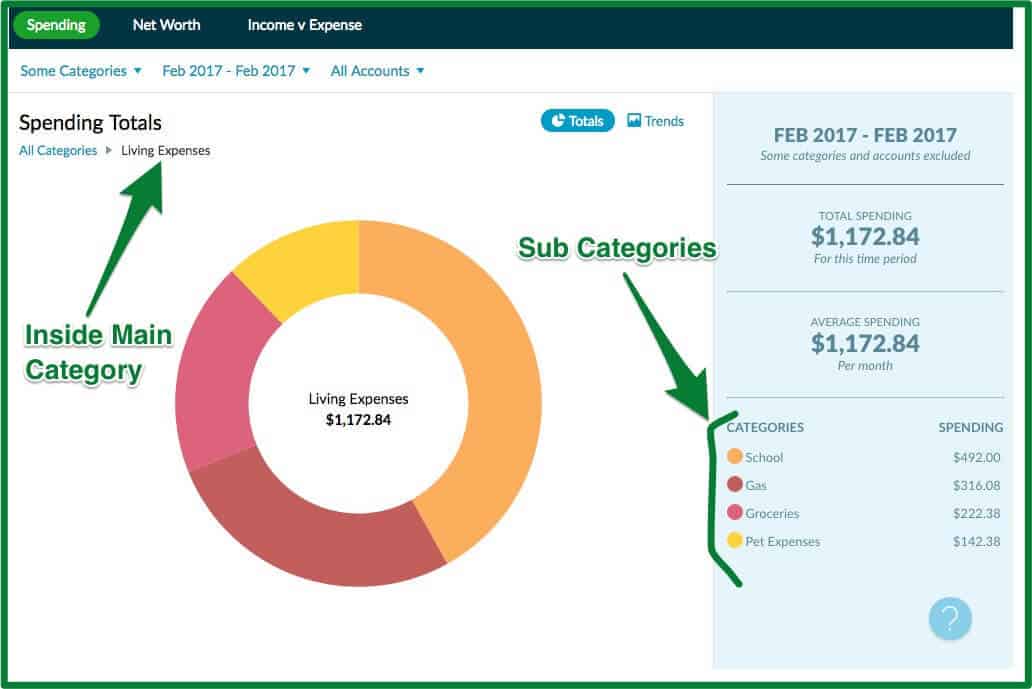

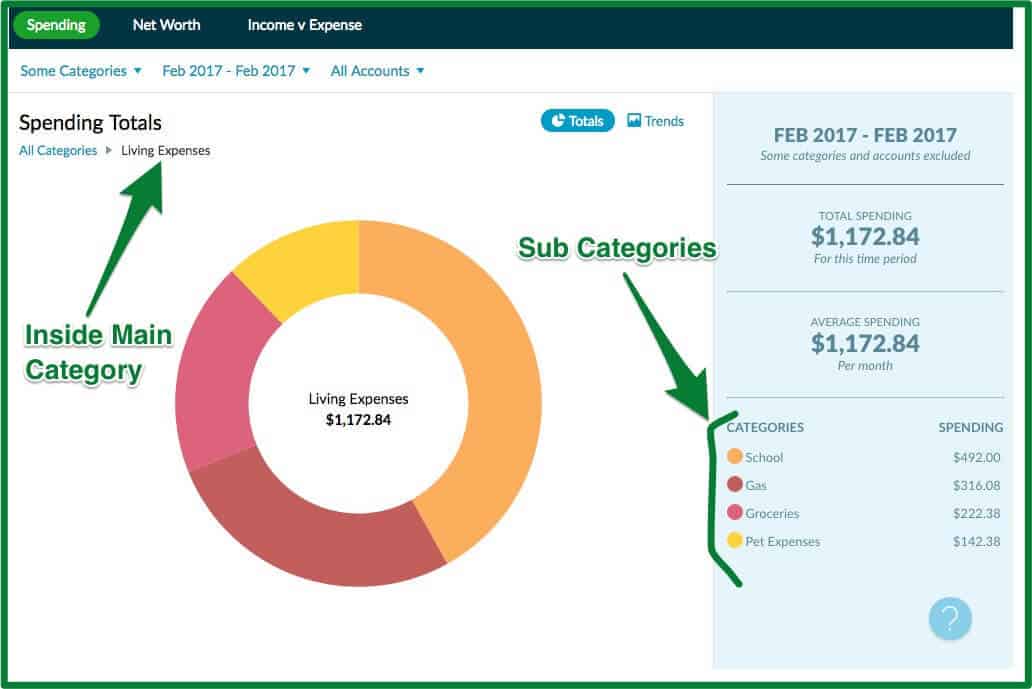

Free credit score – This feature gives you access to your credit score, at no cost to you, and will alert you when there’s been a change in your score. Your financial information will be illustrated with charts and graphs on a month to month or year to year basis, so it’ll be easy to compare and make the necessary changes. Easy budgeting – This feature allows you to identify your spending patterns and help you create a budget that’s easy to stick to. This will help you stay on top of your payments, which is a big factor when it comes to budgeting. Track bills –All of your bills will be organized in one place. All in one – With this feature, you’ll be able to see all of your account balances, bills, and credit score in one place so you’ll know where you stand where you can improve. Mint has a lot of different features that come in handy when you are budgeting, so let’s explore them and see what they are all about. With over 15 million users, Mint has been an extremely useful tool for many people. It has a ton of cool features that’ll help you visualize your spending in an interactive way. Mint vs ynab budgeting 2019 update#

This program will automatically update all of your financial data in just a matter of seconds when you log in to their site. It’s super simple to open an account and get started with them.

Mint vs ynab budgeting 2019 download#

is a free web based personal finance program that allows you to download and link all of your financial data together. We’ll go through their features and show you how they work, so you can decide which financial app is the best fit for you. Here we’re going to explore two of the top financial apps out there, Mint vs YNAB. Luckily, there are budgeting apps that can make it easier for you. Having issues budgeting on your own? Are you tired of creating your own spreadsheets to keep track of your budget?

0 kommentar(er)

0 kommentar(er)